With the main business conference Eurofinance coming up in October in Copenhagen, it is time to warm up with some business intelligence. We are living and working in the fourth industrial revolution with rapid changes as a consequence of digitalization, automation and machine learning. The impact of technology on treasury is significant. If your corporation want to be in pole position and keep succeeding, it is crucial you are a part of this giant transition by implementing new technology and new systems, thus benefit instead of being stressed and left behind.

The fourth industrial revolution

The idea of the fourth industrial revolution was first introduced by professor Klaus Schwab, founder and executive chairman of the World Economic Forum. It is a rapid and profound change of the way we live, work and even define ourselves as human beings. ”It is characterised by a range of new technologies that are fusing the physical, digital and biological worlds, impacting all disciplines, economies and industries, and even challenging ideas about what it means to be human.”

How do this revolution affect the treasury function?

In this perspective it is necessary for international corporates to be aware of how this revolution affects their treasury functions and systems. To be competitive in a near future (read now) corporates must quicker than today be able to support its subsidiaries with easier and faster processes, in turn supporting quicker and more founded decisions. The basis for this is access to critical business data in order to keep competitors behind and quantify the financial risks. Notice the word data here. This is what it is all about. Access to and analysis of big quantities of data is the key to success in the fourth industrial revolution.

Google uses a concept called ”10x thinking” to create an innovative culture. The idea is that innovation happens when you try to improve something by 10 times rather than 10 percent. For this they use data, not opinions. They test and measure almost everything and get a continuous data stream to inform their decisions.

Do you lag or do you lead?

The question for todays’ corporates is: Do we use lagging indicators only, or do we also measure on leading indicators? Lagging indicators are output oriented and only measures what has actually been done or happened – easy to measure but difficult to improve or influence. Leading indicators are input oriented and measures what will affect the business – more complex to measure and easy to influence. Most financial indicators are lagging. But further success demands access to and a good analysis of leading indicators as well.

And this is what the fintech sector basically is about: how we can gather data in a way that make us understand not only what actually has happened, but also what will happen. The ability to predict the future by analyzing data develops and improves corporations. Good old knowledge is the path to success in the fourth industrial revolution.

All three pillars must communicate

To make this happen, all three pillars of a corporations’ financial management in group finance must communicate and have same future-oriented ambitions. These pillars are:

- Group control.

- Group accounting.

- Group treasury.

No matter how the group finance functions are organized or divided in one or more functions to support the business, it is important that they are considered as separate operations, each with its own responsibilities and limits. If one pillar is out of focus or is missing, the whole building collapses. In a corporation it is important that each function communicates well and that the subsidiaries or business areas understand its limits and how to relate to the three pillars. In this rapidly changing world the different functions must understand each others operations including both short and long term goals. If you fail in this you loose your business edge, risk financial leaks, fraud and different kind of penalties.

Do you attract the right people?

I mentioned Google and their 10x innovation idea earlier. In this they also underline the importance of hiring the right people. To attract the best talents of the new generations entering the labour market, corporations must adopt a tech friendly and curious attitude and policy. Otherwise these talents will apply to competitors or other business sectors.

Build your treasury pillar on a solid structure

Build your treasury pillar on a solid structure

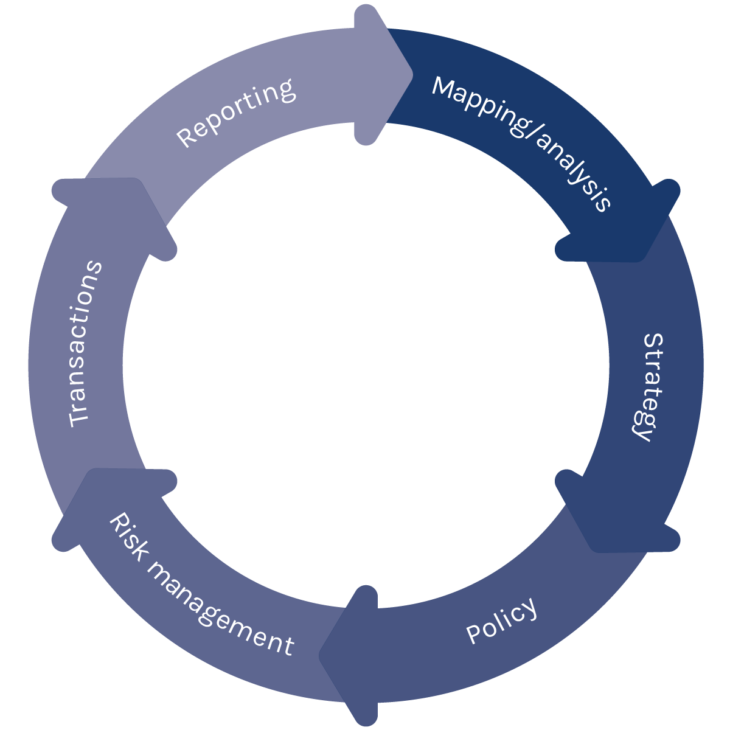

Once again: fintech solutions provide the tools for gathering data and turn group systems transparent and fast. With these prerequisites you can build your treasury pillar on a solid structure:

- Mapping/analysis.

- Strategy.

- Policy.

- Risk management.

- Transactions.

- Reporting.

Why a treasury management system is essential

Digitalization is not much of a help itself. The success is in analyzing the business and the financial flows and processes. This demands continuous streams of data. That is why up-to-date, integrated and transparent treasury management systems are essential parts and a consequence of the fourth industrial revolution – bringing value instead of stress to your business.

Lars Beckman is CEO at CORE Process. Lars has extensive experience in start-up fintech businesses, international internal corporate banks and business development, as well as being a project/customer manager and running large projects. Lars also has deep experience of investment and risk committee work.

Keep updated with insights, trends and best practices in treasury management and working capital solutions.